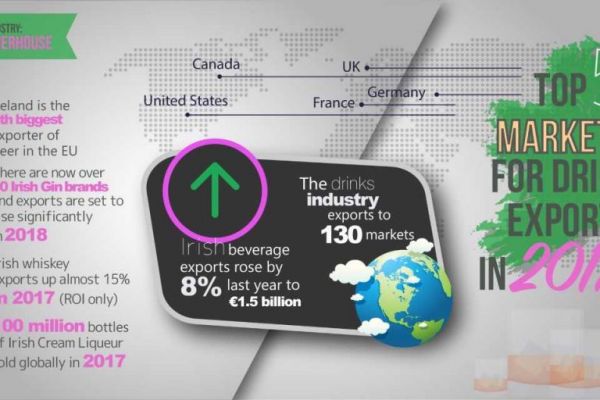

Ireland’s drinks industry exports to over 130 markets and is eyeing new opportunities in 2018, according to Alcohol Beverage Federation of Ireland (ABFI), which has released an analysis of exports from the drinks industry ahead of St. Patrick’s Day. According to the analysis, the top five markets for drinks exports in 2017 were the UK, Germany, France, Canada and the United States. Overall, Irish beverage exports rose by 8% last year to €1.5 billion.

In 2017, overall EU sales rose to €327 million, up 4% versus 2016. There was steady growth in EU markets such as Germany, France, the Netherlands and Spain. Exports to North America also rose steadily to some €650 million in 2017, driven by the growing popularity of Irish whiskey as well as a strong performance from Irish cream liqueurs in the United States.

The Japanese market was the best performing of the Asian countries in 2017, with sales rising by 30% to €9 million. Elsewhere, Russia recorded solid growth to €14 million in 2017, while sales to Africa also increased in 2017 with Irish beer proving popular in Nigeria. According to the industry, drinks producers will continue to take advantage of opportunities in these markets in 2018 and beyond.

Some of the bigger players in the market like Irish Distillers are also exporting to non-typical markets including Mozambique, the Democratic Republic of Congo, South Korea and Cameroon.

In terms of categories, Irish beer continues to perform strongly. Some 40% of beer produced in Ireland is exported and Ireland is the 8th biggest exporter of beer in the EU.

Meanwhile, the surge in popularity of premium Irish spirits continued to drive export growth in 2017. According to the latest CSO stats, Irish whiskey exports grew by almost 15% in 2017. 2017 also saw a breakthrough for Irish gin, with 30 brands now on the market. 2018 is set to see Irish gin going global, with exports expected to grow significantly in the US, Canadian, UK and German markets. Irish cream liqueur exports are also expected to grow in 2018, after the product recovered from a ‘lost decade’ in 2017 and exported 100 million bottles globally.

Patricia Callan, Director of Alcohol Beverage Federation of Ireland (ABFI), said, “Ireland’s drinks industry is an export powerhouse and this analysis confirms the distance our quality products reach, from London to Cameroon and beyond. Based on Bord Bia research, we know that consumers around the world are continuing to choose our premium products and the association with Ireland is proving powerful.

“However, there are challenges ahead. We are concerned about the unintended negative consequences from the advertising and labelling measures being proposed in the Public Health (Alcohol) Bill. Small producers and new entrants that aren’t as established as Carlow Brewing Company and Glendalough Distillery need to be able to grow in the home market before exporting and the Government should not prevent this by creating an uncompetitive market.”