The hospitality industry is globally recognised as one of the most diversified and dynamic sectors. It includes a multitude of interconnected activities, such as travel and tourism, hotels and B&Bs, pubs and restaurants, festivals, sporting events, exhibitions and business conferences.

Usually associated with feel-good moments, the hospitality industry has been one of the quickest and hardest hit sectors by the COVID-19 pandemic, with widespread travel bans and global lockdowns, airline fleets grounded, hotels, restaurant and pubs closed, music and sporting events cancelled, weddings postponed to 2021, and much more.

In addition to the impact of COVID-19, the uncertainty of what Brexit may bring to the Irish hospitality industry looms as the December 31 deadline draws closer.

The wide range of funding supports provided by the Strategic Banking Corporation of Ireland (SBCI) are designed to support all businesses within the sector through the pandemic and beyond. Borrowers can avail of short-, medium- and long-term funding to adapt and react to these new conditions and return to business again.

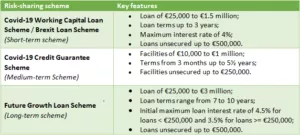

Like the Brexit Loan Scheme, which has recently been extended up to the end of 2021, the COVID-19 Working Capital Loan Scheme is the SBCI short-term funding support. It was made available as the first line of defence for businesses who found themselves suddenly facing the unique challenges and disruption brought about by the pandemic, after the lockdown in March. The scheme offers lending of up to €1.5 million over a three year period, unsecured up to €500,000, at a fixed rate of 4%, and has capacity to deal with an expected upturn in demand in the coming months.

The SBCI medium-term support, the COVID-19 Credit Guarantee Scheme enables borrowers who have been adversely impacted by a minimum of 15% in actual or projected turnover or profit due to COVID-19 and are having difficulty in accessing credit to apply for low-cost funding that might not otherwise be available to them. This scheme was initially due to expire at the end of December of 2020, but its term was recently extended and will now stay open for applications until the end of June of 2021.

Lastly, the Future Growth Loan Scheme, the SBCI's long-term funding, supports not only the development of strategic responses to the changing business conditions brought about by COVID-19 or Brexit, but also allows businesses to focus on their long-term investment requirements. The scheme provides funding from €25,000 up to €3 million over a seven to 10 year period at a very competitive interest rate to eligible businesses, with loans up to €500,000 being unsecured.

The challenges that 2020 has posed, in particular to the hospitality industry, are unprecedented. The SBCI will continue to make its variety of supports available to help businesses overcome this difficult time and get back on track.

Now is the time to reopen the doors.

SBCI Funding Supports Available For The Hospitality Industry

For more information, visit www.sbci.gov.ie.

© 2020 Hospitality Ireland – your source for the latest industry news. Sponsored content. Click subscribe to sign up for the Hospitality Ireland print edition.