The 2023 Dublin licensed-premises property market again witnessed a stable level of activity that was buoyed by good demand, resulting in a consistent volume of sales being completed throughout the year, according to a new report from Lisney Ireland.

The report shows that 21 pubs changed hands, with a combined value in the order of €50 million. This compares to 24 transactions in 2022, realising a combined value of just over €53 million.

Dominant Purchaser Class

Almost 30% of sales completed realised sums north of €3 million, and publicans remained the dominant purchaser class, accounting for approximately 70% of all sales.

Off-market transactions remained a feature of the market, accounting for almost one quarter of all sales completed, according to the report.

Supply

Supply remained consistent throughout 2023, with 76% of all sales completed coming from properties that were publicly offered for sale, compared to 43% in 2022.

Lisney noted that supply was influenced by various factors. Certain offerings were retirement driven, others centred around business realignment, and some were debt and restructure related.

Core Demand

The report found that core demand in 2023 was again focused from within the industry, with publicans remaining the dominant purchaser class, accounting for 70% of the volume and 66% of the value thereof.

Lisney noted that activity within this sector has increased, year on year, over the past three years, which illustrates continued operator confidence within the market.

Developer Activity

Investor demand also remained stable, although it accounted for a slightly lesser volume than it witnessed in 2022, realising 25% thereof and 33% of value.

Developer activity reduced again, representing only 5% of volume and 1% of value, with appetite likely hampered by rising construction costs and planning delays.

Private Equity

The report indicates that private-equity purchasers remained active in sourcing specific opportunities within the upper tier of the market, however, they did not complete any transactions.

When consideration is given to the asset classes targeted by private-equity purchasers, coupled with their specific criteria relating to profitability requirements and future business development potential, Lisney noted that it is clear that that are very few opportunities that meet their specific demands.

The estate agents believe that the scarcity of the opportunity pursued is a direct factor in their reduced activity within the past 24 months.

City Centre Premises

Lisney noted that appetite remained for well-located city centre premises, as illustrated by the sales of JW Sweetman’s, on Burgh Quay, the Barge, on Charlemont Street, the Bachelor Inn, on Bachelors Walk, the Fade Street Social investment, and Grand Social, on Lower Liffey Street.

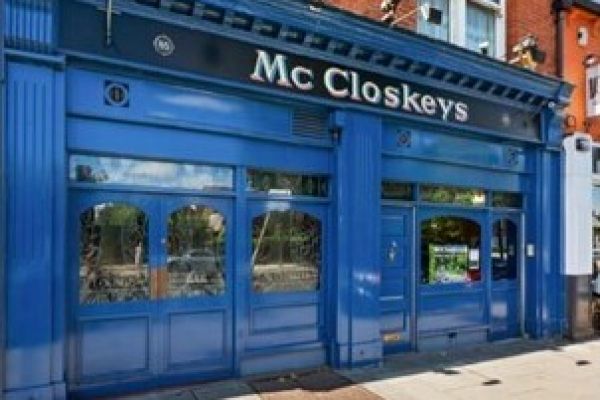

The report shows that the suburban market continued to witness keen demand, with sales completed for large well-known and established premises, such as the Abbey Tavern, Howth, Mulligan’s, Sandymount, the Terenure Inn, Terenure, and McCloskey’s, Donnybrook.

Reversal Of Trend

While off-market activity continued to feature, the 2023 market was characterised by a dominance of transactions completed from public offerings, accounting for 76% of volume and 75% of total value.

Lisney noted that this is a reversal of the trend witnessed in 2022, when off-market transactions accounted for 58% of volume and 69% of value.

‘Trading Challenges’

“Moving into 2024, appetite to acquire remains strong, however, trading challenges do remain. The recent increase in minimum wage, coupled with the VAT increase on food sales, will directly impact on bottom-line profit,” said Rory Browne, divisional director in Lisney’s licensed and leisure department.

“We see publicans remaining as the dominant purchaser class, with developers possibly less active due to the rise in bill costs, coupled with difficulties in securing funding.

“Private equity we see remaining focused on the larger established cities, primarily targeting businesses that enjoy high volumes of trade with strong bottom-line profit.”